Insurance profit margin formula

Where Net Profit Revenue -. A type of business interruption insurance that provides funds in the amount of profit lost if an insurable event such as property damage occurs.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

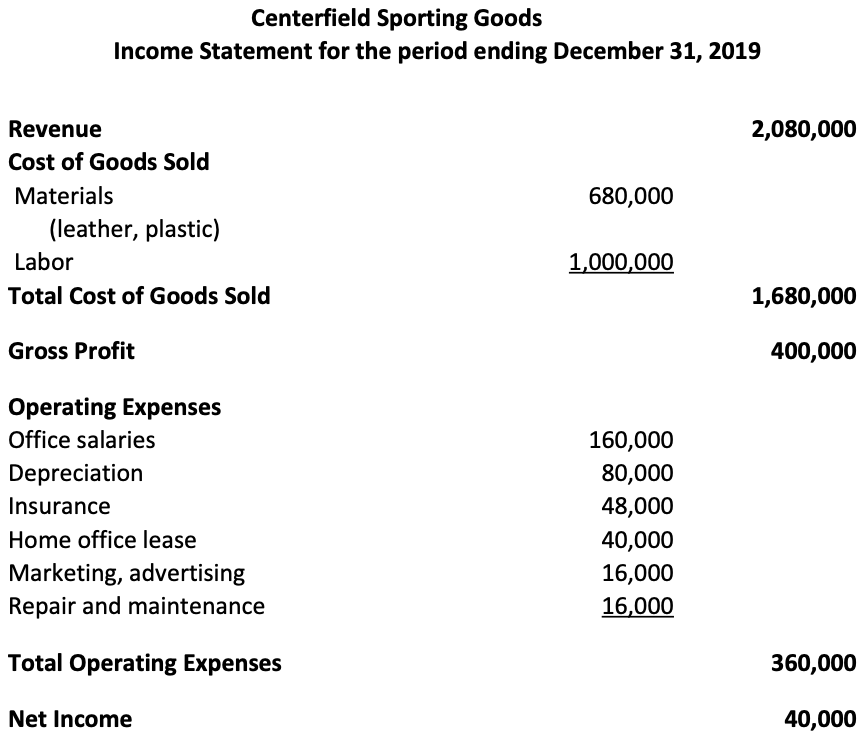

Contribution Margin Net Sales Total Variable Expenses.

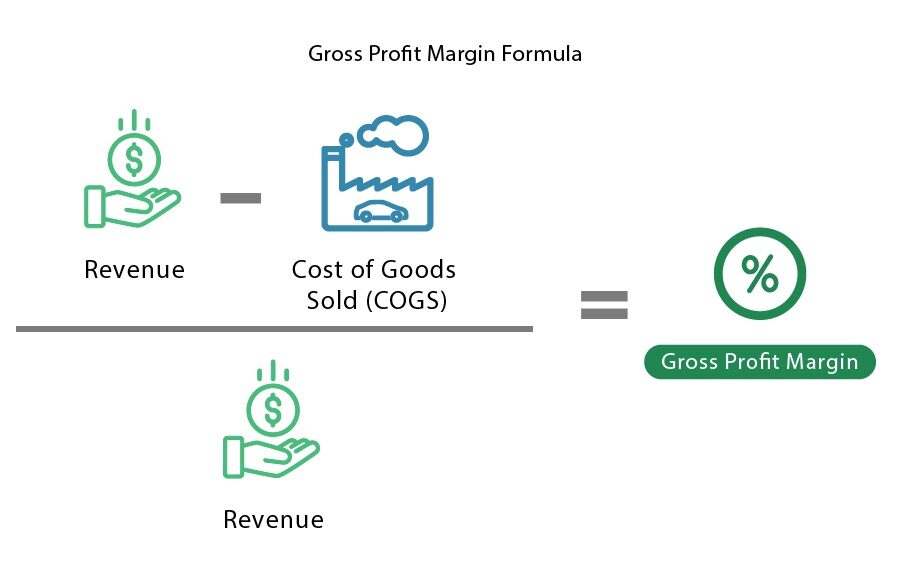

. Now we will deduct the operating expenses from gross profit to determine the. For example if an insurer collects. In order to calculate the profit margin for an insurance broker you should know that the primary way an insurance broker earns money is commissions and fees based on insurance policies.

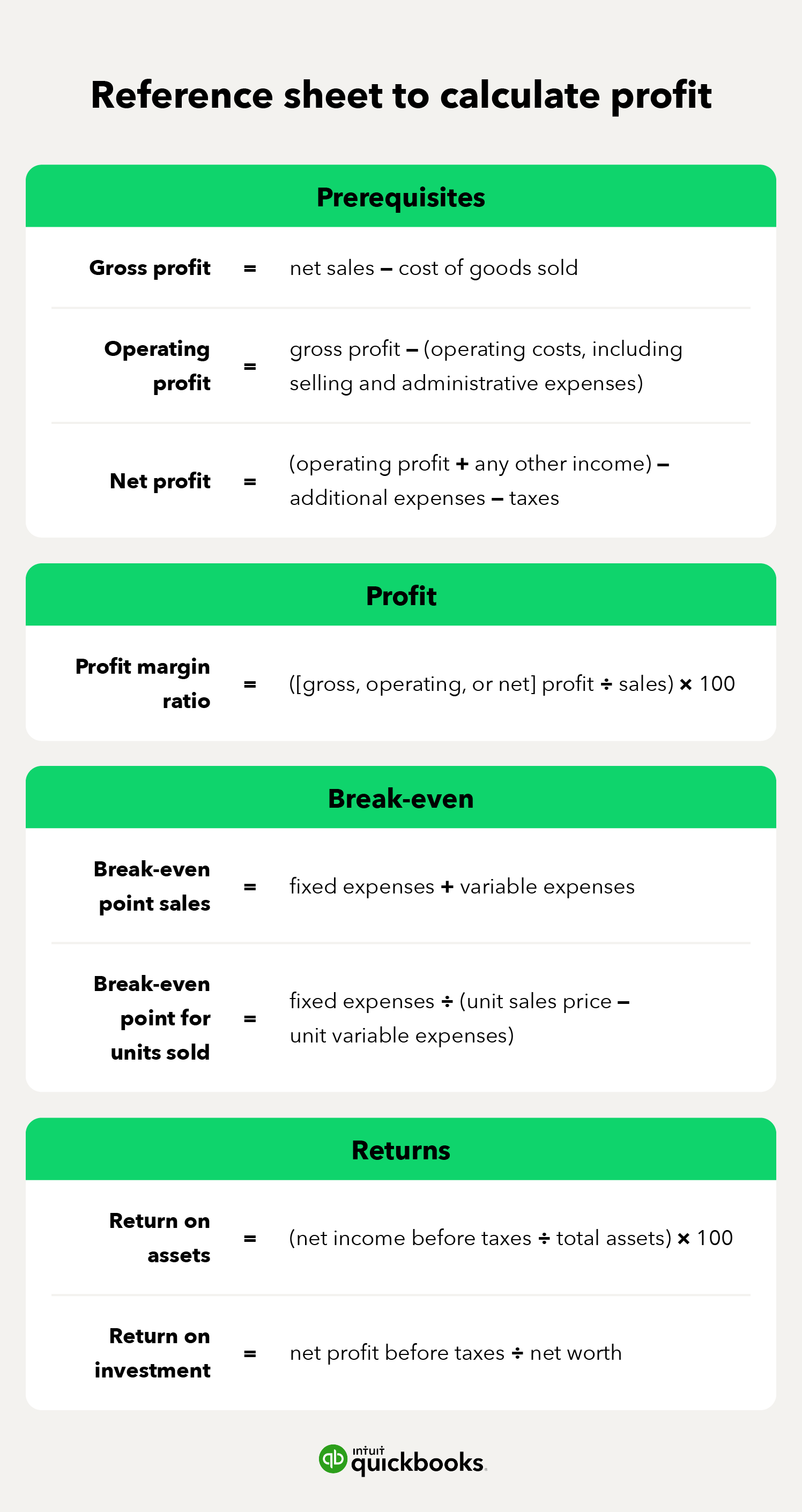

50000 profit 500000 revenue 10 or 10 profit margin Calculating profit is all a bit complicated. We can say that ABC Firm has left over INR. Typically expressed as a percentage net profit margins show how much of each.

Contribution Margin INR 200000 INR 140000. Rates subject to change. Underwriting income is calculated as the difference between an insurance companys earned premiums and its expenses and claims.

Colgate Example Below is the snapshot of. The profit margin formula is used to find the profit margin in a sale. Over a decade of business plan writing experience spanning over 400 industries.

Gross Profits Insurance. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. Contribution Margin INR 60000.

Operating Profit Margin formula Operating Profit Net Sales 100 Or Operating Margin 170000 510000 100 13 100 3333. The insurance margin is the profit made on the float which is called Insurance Profit divided by the NEP. Rates subject to change.

Company A sells hair care products. Youll want to go over your numbers more than once to. Contribution Margin INR 60000.

Insurance Margin Insurance ProfitNet Earned Premium NEP. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. It is the ratio.

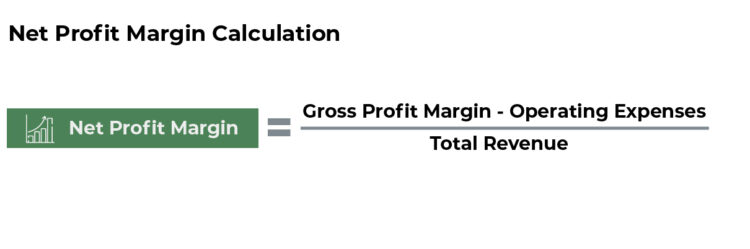

Recognizing revenues using the. Margin rates as low as 283. Net profit margin is the ratio of net profits to revenues for a company or business segment.

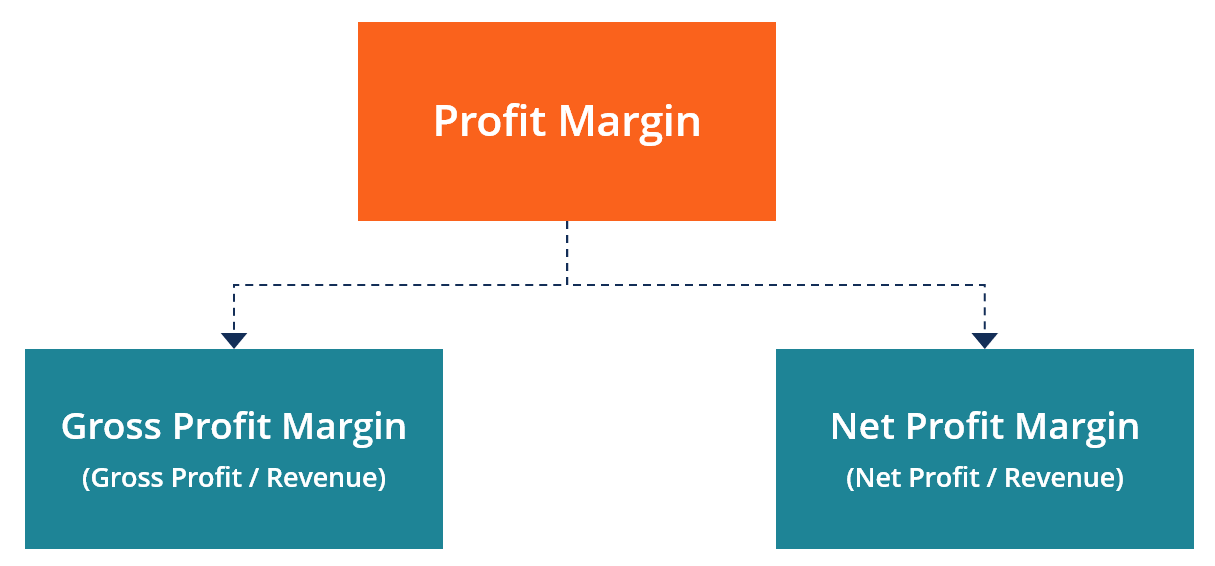

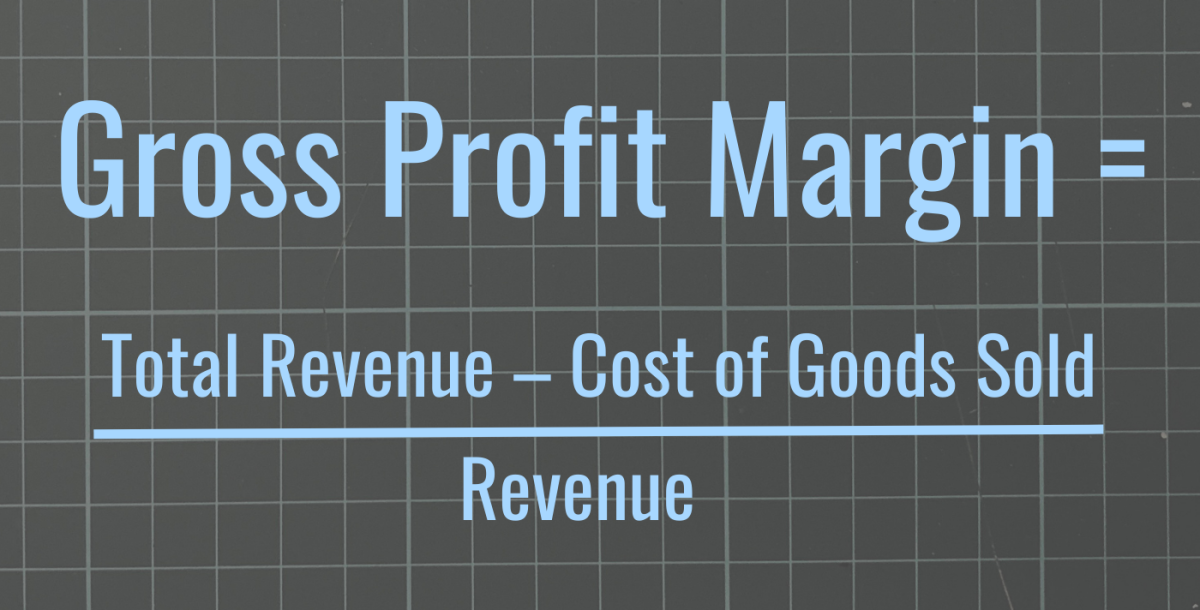

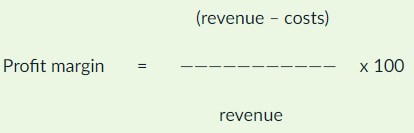

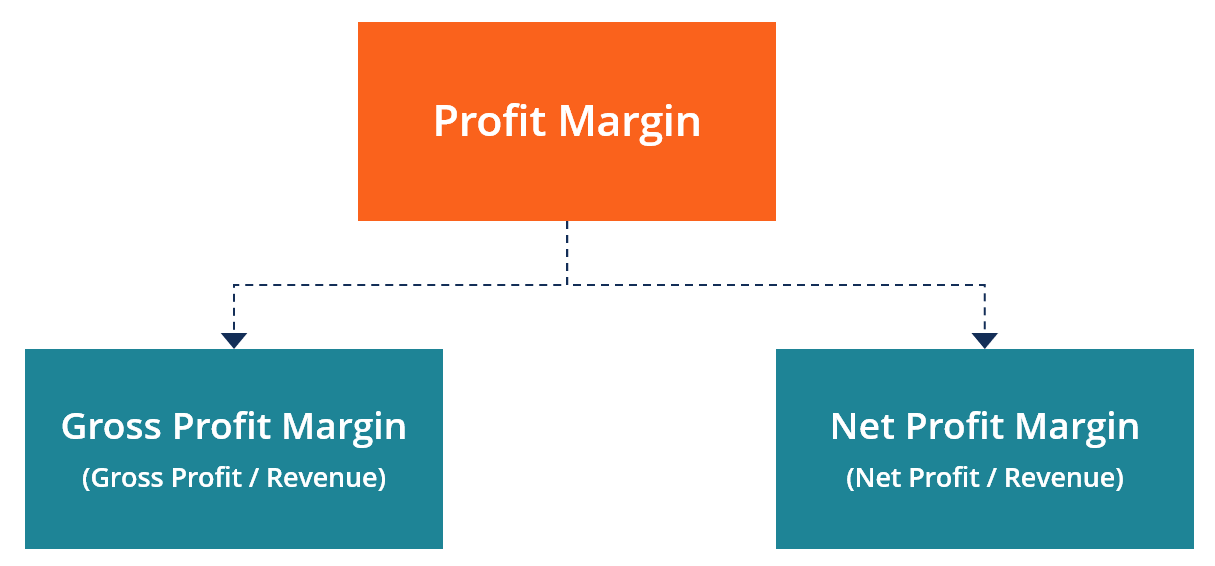

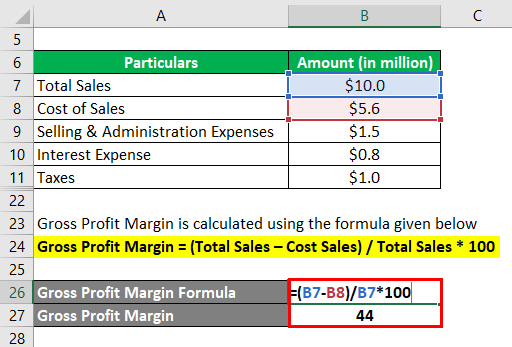

All three have respective profit margins which are calculated by dividing the profit figure by revenue and multiplying by 100. Net Profit Margin Net Profit Revenue Where Net Profit Revenue - Cost Profit percentage is similar to markup percentage when you calculate gross margin. Calculating gross profit margin is simple when using the profit margin calculator.

Several alternative frameworks for determining capital allocation and insurance profit margins are discussed including methods taking into account frictions and methods which value skewness. Profit margin is defined as the revenue generated excluding the expenses divided by the revenue generated. Annualized profit margins for an insurance company.

How Do Gross Profit Margin And Operating Profit Margin Differ

Gross Profit Margin Vs Net Profit Margin Formula

Gross Profit Margin Formula Definition Investinganswers

What Is Profit Margin Definitions How To Calculate Example Faq Thestreet

Profit Margin Formula And How To Calculate Lendingtree

P C Insurance Brokerage Profitability Let S Talk Contingent Profit Commissions Insblogs

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Margin Guide Examples How To Calculate Profit Margins

Profit Margin L Advantages And Limitations Of Profit Margin

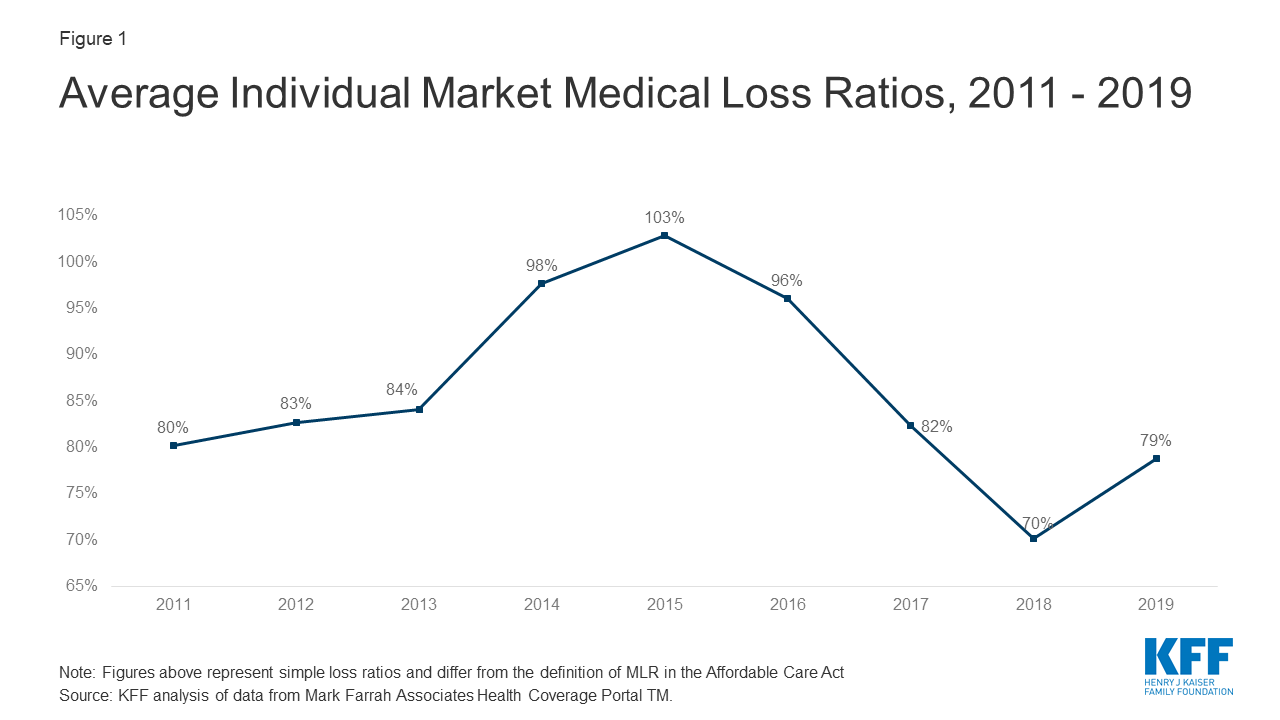

Individual Insurance Market Performance In 2019 Kff

What Is Gross Margin And How To Calculate It Article

Gross Profit Margin Formula Definition Investinganswers

What Is Net Profit And How To Calculate It Glew

Net Profit Margin Formula Definition Investinganswers

5 Metrics To Evaluate Life Insurance Business Mint

How To Measure Your Business Profitability Quickbooks Global

/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

Profit Margin